SUMMARY: June was great at 4.8 million new jobs. July will be over 6 million.

The June 2020 employment report from the Bureau of Labor of Statistics showed an increase of 4.8 million jobs. It was welcomed as good news, but asterisks were quickly added based on the recently surging Covid infection numbers. July, it is feared, will shown softening in the market.

Contrary to many, our data indicates that July jobs report will be better than June, likely exceeding 6 million new jobs.

Our analysis is based on the positive signs we have been tracking in the Hospitality and Retail industries over the past several weeks through our Covid Job Impacts site, where we show new job postings on a daily basis by industry, state, and job family. Within the site’s commentary we have been commenting on the progress in these two industries specifically over the past several weeks.

The BLS highlighted Hospitality and Retail in their June comments. These industries made up ~60% of the new jobs (2.8 million of the 4.8 million) while they make up ~20% of the total employment. Both were severely impacted in the early stages of the pandemic downturn and are now working their way back toward normal staffing activities.

We see Hospitality and Retail combining to create over 4 million new jobs in July, as their job listing activity continues to surge. Most other industries are also showing increased hiring activity, so we estimate they will contribute another 2 million jobs.

The August jobs numbers are a bit more difficult to estimate at this point. As states pause and reverse their opening plans, market uncertainties will drive job listings downward though to what extent and how quickly. At the early stages of the pandemic, companies’ reaction times were a bit slower. Perhaps now they have built up more rapid reflexes.

Job Listings as a Leading Indicator

A company’s decision to advertise a job opening is a clear indicator of their business outlook. If they were not confident at some level, they would delay or cancel the decision to hire. This is true for new, growth hiring as well as backfilling of current positions vacated by resignations or illness. The aggregate of these decisions to hire, as seen in the new job listings data on our Covid Job Impacts site, is therefore a clear and leading indicator for the economy overall.

The site provides views of new job postings by industry, state, and job family, indexed to the job listing levels of March 1st, providing a high-resolution lens on the impacts of Covid-19 on the labor market and overall economy.

Some views of the Covid Job Impacts site are below as reference:

Fig. 1: Overall view of new job listings across all US industries.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

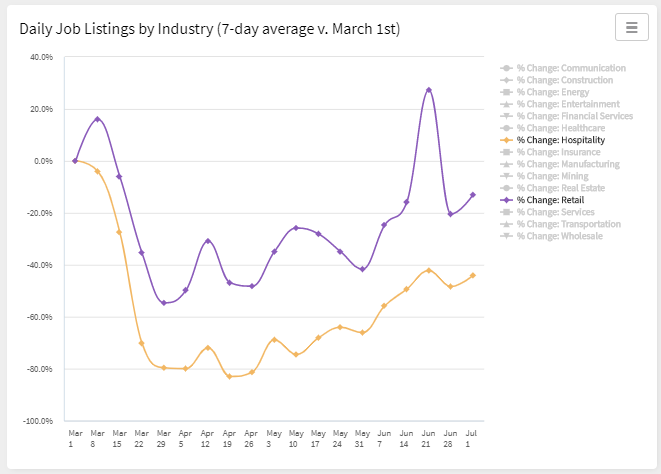

Fig. 2: Industry view of new job listings across all US industries.

Fig. 2: Industry view of new job listings across all US industries.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

Trends in Hospitality and Retail industries

New job listings in Hospitality hit a low in mid-April at around -80% verus March 1st , and have been on a steady path upward since. This is big progress, albeit far below pre-pandemic levels and still around -45% off versus March 1st.

In Retail, the drop was also significant in March, regaining some ground in April and May, then demonstrating strength in June. It is the only industry that, even if for just a moment, has crossed into the positive terrain, exceeding the new job postings figures from March 1st on June 21.

Fig. 3: Hospitality and Retail industry trends show continuing improvement.

Fig. 3: Hospitality and Retail industry trends show continuing improvement.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

BLS summary of Hospitality and Retail in June

In the June BLS report, Hospitality and Retail combined to create 2.84 million of the 4.8 million increase in employment. This is roughly 60% of the added jobs coming from two industry sectors that comprise about 20% of the workforce (roughly 10% each).

From the June BLS report:

Estimating the July Figures for Hospitality and Retail

Emerging alongside this good news from BLS are escalating concerns regarding the employment impacts of states’ policy responses to recently increasing infection rates. These actions will certainly have a downward pressure on job creation across industries, Hospitality and Retail notwithstanding.

However, the trend data for new job listings for Hospitality and Retail indicates that they will further increase employment in the month of July, at least during the period which will be covered in the next BLS report (which for a single week, generally the week including 12th day of the month).

To demonstrate this, we are showing the Hospitality and Retail industry job listing trends along with timing windows to support our estimates for the July report.

Fig. 4: View of Hospitality and Retail industries and June BLS reporting week.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

The very positive results from this particular week in June (Fig. 4) would not be from new job listings within that specific week, since job listings take some time to fill and for a new hire to begin working (and therefore be captured in the BLS data).

While higher paying jobs can require a few months or more to fill, the jobs in Hospitality and Retail that were so significant in the June the report are relatively lower paying, so we would expect that they are requiring only a few weeks to fill. We have added a box to indicate the period of job listing activity that we assume to comprise most of the new jobs in the June report (Fig. 5, Box A).

Fig. 5: Hospitality and Retail industries, with Box A indicating period aligned to June BLS data.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

Looking at a similar time window of job listing activity that will correspond to the employment levels on July 12th (Fig. 6, Box B) provides two key observations:

- the job listings that will be related to new jobs in that week have, for the most part, already been created, and many of them filled; and

- the volume of job listings in the time period that will be reflected in the July report are considerably higher than the levels that drove the very large job numbers in the June report.

Fig. 6: Hospitality and Retail industries, with Box B indicating period aligned to July BLS data.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

Our estimate of 4 million jobs in Hospitality and Retail in the July BLS report is based on the analysis of the job listing volumes in these two industries, focusing on Box A (June report) versus Box B (July report). We can see far greater volumes in the later period.

Where Hospitality gained 2.1 million new jobs in June based on the period in Box A, we estimate that the new figures will be around 3 million. Similarly, where Retail created 740,000 new jobs in June, the increased job listings figures in Box B versus Box A lead us to estimate that this industry will create over 1 million new jobs in the July report.

Fig. 7: Hospitality and Retail industries, with average lines inserted in Boxes A and B.

(Source: Covid Job Impacts site from Greenwich.hr/One Model, data through July 1, 2020)

The next few weeks will be critical to watch

As state policies regarding Covid-19 are adjusted over the next couple of weeks, we will be closely watching the changes in businesses’ hiring plans as seen through their job listing activities. A closer look at state-by-state results on the Covid Job Impacts site will provide a leading indicator and a way to gauge the August BLS report well before it arrives.